by e-LawLines | Dec 14, 2012 | Corporate Law, Probate & Estate Planning Law, Small Business Law, Taxation

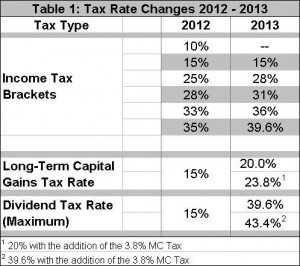

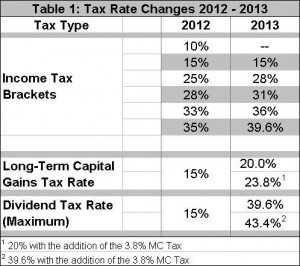

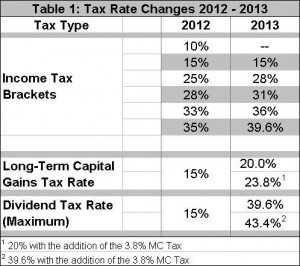

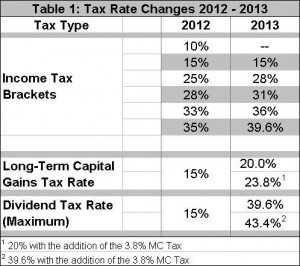

As 2012 draws to a close, it’s important to look at the significant changes that will be made to the Internal Revenue Code (“Tax Code”) beginning in 2013, short of an agreement between the White House and Congress. These changes include the...

by e-LawLines | Nov 8, 2012 | Corporate Law, Employment Law, Small Business Law, Taxation

Today, one of the most pressing issues concerning nearly all small business owners as well as their employees is the impact of the federal health care legislation signed into law by President Obama in March 2010, the Patient Protection and Affordable Care Act...

by e-LawLines | Nov 7, 2012 | Corporate Law, Employment Law, Small Business Law

Beginning January 1, 2013, employers are required to provide a new version of the form entitled “Summary of Your Rights Under the FCRA” (“Summary of Rights”) to individuals before taking any adverse action based on the contents of a consumer...

by e-LawLines | Aug 30, 2012 | Corporate Law, Probate & Estate Planning Law, Real Estate Law, Small Business Law

There are so many variable expenses when starting or growing your business that there is no reason to voluntarily agree to another one, especially when it is often a major expense. That would be the cost of occupancy for your business. And the landlord should want a...

by e-LawLines | Jun 21, 2012 | Corporate Law, Small Business Law

On March 27, 2012, Congress passed the Jumpstart Our Business Startups Act (the “JOBS Act”), which President Obama signed on April 5, 2012. While this is a great deal for smaller companies, many of these provisions address companies of a much larger size...

by e-LawLines | May 25, 2012 | Corporate Law, Employment Law

In what will likely be significant decision in the area of employment law, the Missouri Court of Appeals recently broadened the public policy exception to Missouri’s at-will employment doctrine. In Delaney v. Signature Health Care Foundation, the plaintiff learned...