by e-LawLines | Apr 11, 2016 | Probate & Estate Planning Law

Morse v. Volz, 808 S. W. 2d 424, is a case involving Marvin Morse, who died in 1986. His first wife, with whom he had one child, predeceased him in 1978. He remarried in 1984 to a woman who had a child by her first marriage. The second wife died in 1987. Before his...

by e-LawLines | Jul 25, 2014 | Litigation, Probate & Estate Planning Law

The Missouri Court of Appeals has upheld a jury verdict of $850,000 against a former co-trustee after a trust which he co-managed was depleted of over a million dollars without such monies going to the beneficiaries. The appeals court found sufficient evidence that...

by e-LawLines | Feb 14, 2014 | Probate & Estate Planning Law

Missouri appeals court ruled that while an inequitable distribution of assets among the decedent’s children illustrates an unfortunate breakdown in the relationships between members of her family, the final bequest would not be disturbed because the trial judge...

by e-LawLines | Aug 27, 2013 | Probate & Estate Planning Law

A recent decision by the Missouri Court of Appeals now requires rethinking with respect to the structure and effectiveness of Health Care Durable Powers of Attorney that contain provisions regarding “right of sepulcher.” The right of sepulcher refers to...

by e-LawLines | Jan 4, 2013 | Corporate Law, Probate & Estate Planning Law, Small Business Law, Taxation

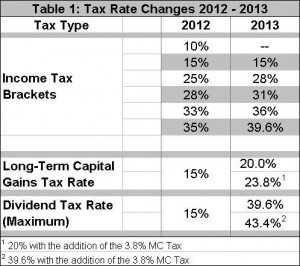

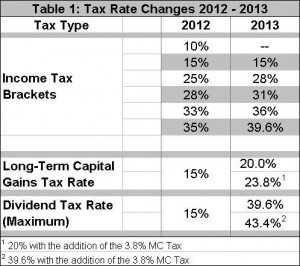

In a move to avoid the fiscal cliff, the U.S. Senate, early on the morning of January 1, 2013, overwhelmingly passed a compromise bill, H.R. 8, the American Taxpayer Relief Act of 2012 (“ATRA”), to extend and replace numerous provisions of the Internal...

by e-LawLines | Dec 14, 2012 | Corporate Law, Probate & Estate Planning Law, Small Business Law, Taxation

As 2012 draws to a close, it’s important to look at the significant changes that will be made to the Internal Revenue Code (“Tax Code”) beginning in 2013, short of an agreement between the White House and Congress. These changes include the...