by e-LawLines | Sep 17, 2013 | Corporate Law, Employment Law, Small Business Law, Taxation

The Patient Protection and Affordable Care Act (“ACA”) requires that all employers covered by the Fair Labor Standards Act notify their employees by Oct. 1, 2013, of the coverage options available to them through the Health Insurance Marketplace. Who Must...

by e-LawLines | Jul 3, 2013 | Corporate Law, Employment Law, Small Business Law, Taxation

The Treasury Department in conjunction with the Obama administration announced yesterday that implementation of certain provisions of the Affordable Care Act (ACA) will be delayed until 2015. These provisions include the employer shared-responsibility provisions as...

by e-LawLines | May 31, 2013 | Employment Law, Small Business Law, Taxation

The Affordable Care Act (ACA) added a section to the Fair Labor Standards Act (FLSA) that said an applicable employer must provide a written notice to each existing employee. The original deadline of March 1, 2013 has now been extended by the Department of Labor....

by e-LawLines | Apr 23, 2013 | Real Estate Law, Taxation

2013 is a “Reassessment Year” for real property taxes in Missouri. Although a property owner’s right to appeal an assessment is available in any year, such right is most often exercised only in “reassessment years.” Unless special...

by e-LawLines | Jan 4, 2013 | Corporate Law, Probate & Estate Planning Law, Small Business Law, Taxation

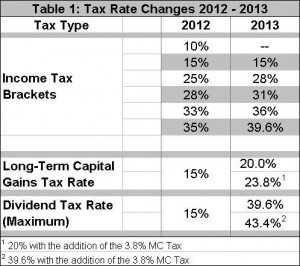

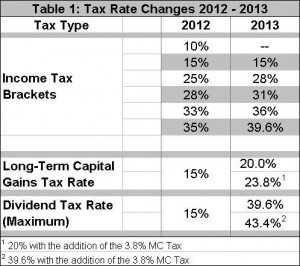

In a move to avoid the fiscal cliff, the U.S. Senate, early on the morning of January 1, 2013, overwhelmingly passed a compromise bill, H.R. 8, the American Taxpayer Relief Act of 2012 (“ATRA”), to extend and replace numerous provisions of the Internal...

by e-LawLines | Dec 14, 2012 | Corporate Law, Probate & Estate Planning Law, Small Business Law, Taxation

As 2012 draws to a close, it’s important to look at the significant changes that will be made to the Internal Revenue Code (“Tax Code”) beginning in 2013, short of an agreement between the White House and Congress. These changes include the...