As 2012 draws to a close, it’s important to look at the significant changes that will be made to the Internal Revenue Code (“Tax Code“) beginning in 2013, short of an agreement between the White House and Congress. These changes include the expiration of the 2001 and 2003 changes to the Tax Code—the “Bush Tax Cuts,” a compromise on the estate and gift tax, a patch in the alternative minimum tax, the temporary 2% “Payroll Tax Holiday,” increased business expensing and multiple deductions as part of a “Tax Extenders” package. In addition, on January 1, 2013, additional taxes begin to go into effect as a result of the Patient Protection and Affordable Care Act (“ACA“).

Last month, we addressed the impact on businesses as a result of the changes brought about by the ACA. See The Impact of the Affordable Care Act.

Now part of what is being called the “Fiscal Cliff,” the expiration of tax code provisions, without congressional intervention, will result in significant tax increases for individuals and trusts. Unfortunately, there is a significant level of uncertainty with respect to what actions Congress may take, if any, leaving many individuals in a state of flux. However, regardless of Congress’ actions, there are several planning opportunities that exist that may allow a rappel off the fiscal cliff, versus an all-out free-fall—thus providing a much softer landing into 2013. Below you will find a description of the changes that will be occurring as well as planning strategies to help reduce the impact of the changes.

The Expiration of the Bush Tax Cuts

In 2001 and 2003, President Bush signed into law significant tax reductions for nearly all taxpayers (the “Bush Tax Cuts“). As a result, a new 10% tax bracket was introduced as well as marginal rate reductions. Because the bills were passed using a Senate procedure known as “reconciliation,” which is prohibited for any bill that affects budget deficits beyond a 10-year window, the tax cuts included a “sunset” provision, which caused the tax cut provisions to automatically expire at the end of 2010. A compromise in 2010 extended the provisions for two years to the end of 2012. As a result of the expiration of the Bush Tax Cuts, and absent any action from Congress, many tax provisions will revert to pre-2001 law.

Patient Protection and Affordable Care Act Tax Provisions

While the expiration of the Bush Tax Cuts will result in substantial changes, the tax situation in 2013 is further impacted by the implementation of provisions of the ACA. Beginning after December 31, 2012, the changes include the addition of a 3.8% Medicare Contribution Tax that applies to net investment income (“NII“) of high-income earners, a Medicare Hospital Insurance payroll tax of 0.9%, as well as an increase in the adjusted gross income (“AGI“) threshold for deduction of medical expenses for most individuals.

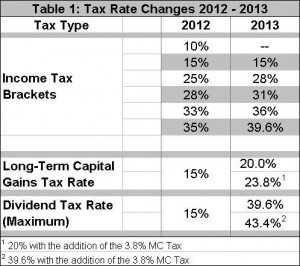

Income Tax Rates

As a result of the expiration of the Bush Tax Cuts, the income tax rates will revert to their earlier, higher, rates. With respect to the income tax rate for individuals, the lowest income tax bracket of 10% will expire, reverting to 15%. The top four income tax brackets will see rate increases: the 25% bracket will rise to 28%, the 28% bracket will rise to 31%, the 33% bracket will rise to 36%, and the top bracket will rise from 35% to 39.6%.

Dividends

Currently, qualified dividends are taxed at 0% for taxpayers in the 10% and 15% brackets and 15% for all other taxpayers. As a result of the expiration of the Bush Tax Cuts, the tax rates on qualified dividends are scheduled to increase to ordinary income rates.

Planning Strategies:

Declaration and Distribution of Dividends in 2012. For those in control of C corporations with a sufficient amount of earnings and profits, one strategy to avoid the higher rate in 2013 is to declare special dividends to be distributed by the end of 2012—this strategy will be especially valuable if the top rate on dividends rises from 15% to 43.4%, which is 39.6% plus the 3.8% Medicare Contribution Tax (as discussed below).

Dividend Methods. In order to distribute dividends by year-end, several methods may be used, including payment of a cash dividend, redemption of shares of stock of the corporation as well as potentially using promissory notes of the corporation to pay dividends.

Capital Gains

Similar to dividends, long-term capital gains are currently taxed at 0% for taxpayers in the 10% and 15% brackets and at 15% for all other taxpayers. However, these rates are to increase to rates of 10% for those in the 15% tax bracket and a maximum 20% rate for all other taxpayers.

Planning Strategies:

Accelerating Gains / Deferring Losses. The appropriate strategy to use is determined by whether the capital assets include highly appreciated assets or assets with losses. If the capital assets are highly appreciated, it would be valuable to accelerate the recognition of long-term gains in 2012. However, if the disposition of the capital asset property would result in a loss, it may be beneficial to defer recognition of the loss into 2013 or later, in order to be used to offset later gains that will be taxed at potentially higher capital gain rates.

Resetting Basis. Another planning opportunity includes the recognition of gains in 2012, with an immediate repurchase—thereby “resetting basis” to help reduce the impact of a higher tax rate on capital gains as well as the 3.8% Medicare Contribution Tax, when the asset is finally disposed of in the future. When selling an asset, such as a security, and then immediately repurchasing, one has to be conscious of the “Wash-Sale Rule,” which prohibits claiming a tax-deductible loss on a security if the same or substantially identical asset is repurchased within 30 days of the sale. Keep in mind, however, that the non-recognition rule applies only to losses—gains are recognized in full. In addition to the foregoing, when using a planning strategy like resetting the basis of certain assets, note that the taxes on appreciated assets will still have to be paid for 2012; thus, one must consider whether additional capital will be required for payment of the resulting taxes or if a lesser amount will be reinvested.

The Medicare Contribution Tax

As mentioned above, the ACA imposes a 3.8% Medicare Contribution Tax (“MC Tax“) on the unearned income of higher-income taxpayers. The MC Tax applies to net investment income and will apply generally to passive income. NII generally includes interest, dividends, annuities, royalties, rents, capital gains and passive activity income.

The MC Tax will be imposed on individuals that are above certain levels of income. That is, the MC Tax will be imposed on the lesser of the NII or the excess of modified adjusted gross income (“MAGI“) over the threshold amount—the threshold amount being $250,000 if married filing jointly, $125,000 for those married filing separately or $200,000 for all other taxpayers. Taxpayers who have NII but whose MAGI is below the threshold will not be subject to the MC Tax. Similarly, those with income above the MAGI threshold, but whose income type is not one of those listed above, will also not be subject to the MC Tax.

Furthermore, gain from the disposition of an interest in a partnership or an S corporation constitutes NII to the extent of the net gain that is attributed to the entity’s non-business property. In addition, net gain or loss attributable to an active trade or business in which the taxpayer materially participates is not taken into account when computing NII.

Planning Strategies:

Sale of Highly Appreciated Assets in 2012. One option, as mentioned above, is to sell capital gain property in 2012, before the MC Tax applies. Such a strategy will likely be valuable if the taxpayer is facing large capital gains, such as from the sale of a principal residence that is above the $250,000 or $500,000 exclusion amounts.

Changes in Source of Income. Another option is to consider a change in the source of income. For example, it may be beneficial to invest in tax-exempt bonds as the interest from the bonds does not figure into NII or MAGI. One may also consider rental real estate. While rental income from such an investment typically creates passive income that could be subject to the MC Tax, such property frequently generates a net loss after depreciation and as a result, would not produce NII that would be subject to the MC Tax. However, the gain resulting from the later disposition of the rental real estate property may be subject to the MC Tax.

IRA Distributions. Another issue to keep in mind is that while the MC Tax does not apply to distributions from qualified plans or IRAs, the taxable distributions will count toward increasing MAGI, which could cause other NII to be subject to the MC Tax. As a result, taxpayers who are newly retired may wish to take required minimum distributions immediately before year-end 2012.

The Medicare Contribution Tax Impact to Trusts and Estates

The MC Tax also applies to trusts and estates. With a trust or estate, the MC Tax is imposed on the lesser of undistributed NII or the excess of adjusted gross income over the dollar amount at which the highest income tax bracket applicable to a trust or estate begins. For 2013, the highest bracket is projected to begin at $11,950.

Planning Strategies:

Distributions of NII to Beneficiaries. As a result of the MC Tax applying to trusts and estates, net income should be distributed to beneficiaries rather than having it taxed in the trust or estate. A trust or estate’s NII will be subject to the MC Tax at a significantly lower threshold than a beneficiary—$11,950 in 2013, while the NII received by the beneficiary will be subject to the MC Tax above a much higher threshold—$250,000 if married filing jointly, $125,000 for those married filing separately or $200,000 for all other taxpayers.

Table of Rate Changes

The following table shows the income tax rate changes if no congressional action is taken before January 1, 2013. (Click table for larger view)

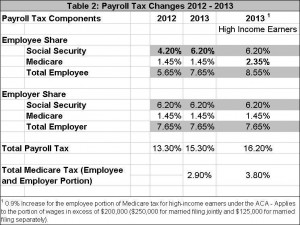

Payroll Taxes

Payroll Tax Holiday

Prior to 2010, wage earners and their employers split a 15.3% payroll tax. Employees paid 6.2% for Social Security and 1.45% for Medicare, while 6.2% was paid by employers for Social Security and 1.45% was paid by employers for Medicare. However, as a result of the temporary payroll tax cut included in the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 and extended by the Temporary Payroll Tax Cut Continuation Act of 2011 (the “Payroll Tax Holiday“), employees in 2011 and 2012 had a 2% reduction in the Social Security payroll tax resulting in the employee share of Social Security being 4.2% and the employer share being 6.2%, for a total of 10.4%.

Because the Payroll Tax Holiday is expiring, after December 31, 2012, employees will again pay 6.2% for their share of Social Security.

Planning Strategies:

Acceleration of Bonuses and Other Earned Income. In 2012, the payroll tax holiday applied to qualified wages up to the Social Security wage base of $110,100. Therefore, accelerating any bonuses or other special employee compensation into 2012 for employees who will be below the $110,100 ceiling at year-end 2012 may allow them to obtain 2% more. The same will also apply for self-employed individuals.

Medicare Hospital Insurance Payroll Tax

Furthermore, pursuant to the ACA, an additional 0.9% Medicare Hospital Insurance payroll tax (“HI Tax“) will cause an additional payroll tax increase for high-income earners. The HI Tax will cause the employee Medicare portion of the payroll tax to increase 0.9% from 1.45% to 2.35% for the amount of earned income in excess of certain threshold amounts. The threshold amounts being $250,000 for married filing jointly, $125,000 for married filing separately and $200,000 for all other taxpayers. As a result, the total Medicare payroll tax, including the employer share will rise from 2.9% to 3.8%.

Planning Strategies:

Acceleration of Earned Income. For individuals and married couples who may be subject to the HI Tax, accelerating service-related income into 2012 may help to both avoid the HI Tax as well as the additional tax rates increases due to the expiration of the Bush Tax Cuts.

Payroll Tax Changes Table

(Click table for larger view)

Alternative Minimum Tax

Congress has routinely “patched” the alternative minimum tax (“AMT“). The AMT patch raises the AMT exemption level, increasing the amount a taxpayer must earn before being subject to the AMT. The most recent AMT patch occurred in 2010 to cover tax year 2011. At that time, Congress set an exemption level of $48,450 ($74,450 for married couples) for calendar year 2011. As a result, Congress prevented a drop in the exemption level to $33,750 ($45,000 for married couples), thereby avoiding a substantial increase in the number of taxpayers subject to AMT. The 2010 AMT patch expired on December 31, 2011 and needs to be patched again prior to taxpayers filing their 2012 tax forms, which are due mid-April 2013. If not patched, many taxpayers who previously avoided AMT will suddenly find themselves subject to AMT.

Estate and Gift Tax

The current estate and gift tax effective through 2012 is set at a maximum rate of 35% with a $5.12 million exemption amount. Unless extended, the maximum estate tax rate will revert to 55% after 2012 with a $1 million exemption amount.

Planning Strategies:

Annual Gifting. There are numerous potential strategies. However, it is a good idea to continue with annual gifting, as the annual gift tax exclusion in 2012 is $13,000, with $26,000 allowed to each donee by married couples making a split-gift election. The annual gift exclusion will rise to $14,000 in 2013, with $28,000 available to each donee with a split-gift election for married couples.

Gifting of Appreciated Assets. Also, combining the annual exclusion with the 0% capital gains rate for donees in the 10% to 15% income tax bracket may also be advantageous, especially with gifts of highly appreciated property.

Tax Deduction Changes

Personal Exemption Phaseout / Itemized Deduction Limitation. Effective January 1, 2013, higher-income taxpayers may be subject to the return of the Personal Exemption Phaseout (“PEP“) and the Pease Limitation of itemized deductions.

Personal Exemption Phaseout. The revival of the PEP rules would reduce or eliminate the deduction for personal exemptions for higher-income taxpayers starting at a projected inflation-adjusted amount of approximately $265,000 AGI for married filing jointly and approximately $175,000 AGI for individuals.

Pease Limitation. The return of the Pease Limitation on itemized deductions would reduce itemized deductions by 3% of the taxpayer’s AGI in excess of the threshold inflation-adjusted amount, but not by more than 80% of the itemized deductions otherwise allowable for the tax year. The inflation-adjusted income threshold is projected to be approximately $175,000 for 2013.

Planning Strategies:

Accelerating Itemized Deductions. Individuals may want to consider accelerating itemized deductions if they may be subject to the Pease Limitation. Several examples include making charitable gifts, or paying certain state income or property tax payments. However, this will also have to be balanced with the fact that higher tax rates will likely be implemented in 2013. Therefore, taxpayers will be advised to analyze the benefit of deduction deferral in light of the tax rate increases and the risk that deductions could be limited in 2013 as a result of the return of the Pease Limitation.

Higher Threshold for Medical Expense Deductions

Previously, the allowable itemized deduction for unreimbursed medical expenses equaled the excess of your qualified medical expenses over 7.5% of your adjusted gross income. However, as a result of changes made by the ACA, starting in 2013, the deduction threshold will be raised to 10% of AGI for most individuals. There is an exception, however, for those who will be age 65 by December 31, 2013. For those individuals, the 10% over AGI threshold will not take effect until 2017. If they turn 65 sometime after December 31, 2013, but before December 31, 2016, the 7.5% will apply for them beginning the year they turn 65 and will continue until 2017. Starting in 2017, the higher 10% threshold will apply for everyone.

Planning Strategy:

Accelerating Qualified Medical Expenses. Taxpayers who anticipate incurring qualified medical expenses for purposes of the itemized deduction may wish to accelerate those expenses into 2012.

New Limit on Health Care Flexible Spending Account Contributions

A health care Flexible Spending Account (“FSA”) plan allows individuals to deduct pre-tax dollars from their salary to be contributed to an FSA. The funds contributed to the FSA can then be used to reimburse the individual tax-free to cover qualified medical expenses. Previously, there was no limit on the amount individuals could contribute each year to their employer’s health care FSA plan other than the limit imposed by the employers themselves. However, as a result of the ACA, starting in

2013, the maximum annual FSA contribution will be limited to $2,500 for each employee.

Planning Strategy:

Acceleration of Medical Expenses. Because of the cap that will be imposed in 2013, individuals may want to consider accelerating certain health care expenses into 2012 if possible. However, certain plans may allow for reimbursement of the 2012 FSA contribution amounts into early 2013.