Estate Planning and Probate

Probate is the legal process of resolving all claims and distributing a deceased person’s property, or estate, according to a valid will. A will has to be “probated” by a court, which means the court has to confirm the validity of a deceased person’s will so that interested parties can rely on its authenticity.

Estate planning is the process of accumulating and distributing a person’s estate in a way that maximizes what is transferred to the estate owner’s intended beneficiaries while minimizing taxes and probate court involvement.

Understanding Wills, Trusts, and Other Probate and Estate Planning Tools

We have years of experience drafting wills and trusts for individuals and business owners. We can advise you on a range of probate and estate planning tools, including durable powers of attorney, medical care powers of attorney, elder law planning, establishing guardianships, conservatorships, living wills, contested wills and probate administration.

This is a sampling of the probate and estate planning law services we provide to individuals:

- Conservatorships

- Durable Powers of Attorney

- Elder Law Planning

- Estate Planning for Digital Assets

- Guardianships

- Living Wills

- Medical Care Powers of Attorney

- Probate Administration

- Trust Disputes

- Trusts

- Will Contests

- Wills

Estate Planning and Probate Articles

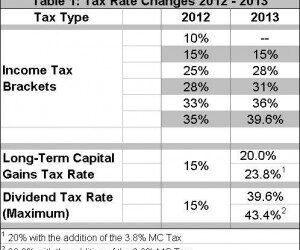

A Soft Landing From the Fiscal Cliff; Tax Highlights of the American Taxpayer Relief Act of 2012

In a move to avoid the fiscal cliff, the U.S. Senate, early on the morning of January 1, 2013, overwhelmingly passed a compromise bill, H.R. 8, the American Taxpayer Relief Act of 2012 ("ATRA"), to extend and replace numerous provisions of the Internal Revenue Code,...

End-of-Year Tax Planning—Avoiding a Free-Fall Off the Fiscal Cliff; How to Rappel to a Softer Landing

As 2012 draws to a close, it's important to look at the significant changes that will be made to the Internal Revenue Code ("Tax Code") beginning in 2013, short of an agreement between the White House and Congress. These changes include the expiration of the 2001 and...

Minding the Mine Fields: Commercial Leases and Hidden Costs

There are so many variable expenses when starting or growing your business that there is no reason to voluntarily agree to another one, especially when it is often a major expense. That would be the cost of occupancy for your business. And the landlord should want a...

It Might Not Get Easier in the Hereafter; Estate Planning for Digital Assets

We are gradually, and grudgingly, learning that our online presence can outlive our physical presence and possibly take on a life of its own. As we begin to move more of our activities — financial, social, work, leisure, creative — to the Internet, the question about...