Affordable Care Act

The Patient Protection and Affordable Care Act, also known as the Affordable Care Act (ACA), or colloquially as “Obamacare,” was signed into law in March of 2010 with the goal of increasing the quality and affordability of health insurance for millions of Americans.

While the Act’s employer shared responsibility payments will not apply until 2015, and in some cases, not until 2016, there are provisions and safe harbors to consider and decisions that can be made now that may help businesses, employees and a business’s bottom line. Further, there are many unintended consequences arising out of the ACA that business owners, both large and small, need to consider when administering health care arrangements.

We are carefully following the developments associated with the roll-out of ACA and are providing counsel to business owners and other professionals, helping them to address compliance issues, evaluate exposure to penalties and other tax issues as well as planning strategically for the future.

Affordable Care Act Articles

Today Seems a Good Day to Thank Mighty Musial

When Stan the Man died on Saturday at the age of 92, it reminded us all of what we truly love about baseball. Hall of Famer Stanley Frank Musial, humble and scandal-free to the end, ground out impressive records day in and day out, just by performing his job. He...

Are Your Company’s Business Records Up-to-Date?

It happened again. The pesky problem of keeping business records up to date with the Missouri Secretary of State's Office resulted in a default judgment of $9.7 million, which mushroomed to over $11 million by the time the successful plaintiff got around to collecting...

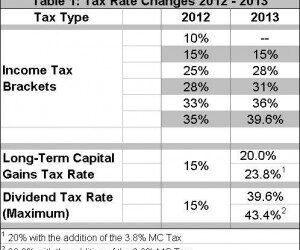

A Soft Landing From the Fiscal Cliff; Tax Highlights of the American Taxpayer Relief Act of 2012

In a move to avoid the fiscal cliff, the U.S. Senate, early on the morning of January 1, 2013, overwhelmingly passed a compromise bill, H.R. 8, the American Taxpayer Relief Act of 2012 ("ATRA"), to extend and replace numerous provisions of the Internal Revenue Code,...

End-of-Year Tax Planning—Avoiding a Free-Fall Off the Fiscal Cliff; How to Rappel to a Softer Landing

As 2012 draws to a close, it's important to look at the significant changes that will be made to the Internal Revenue Code ("Tax Code") beginning in 2013, short of an agreement between the White House and Congress. These changes include the expiration of the 2001 and...